Reference

This GL interface relates to the Dissect the Sales Desk fields in the Config GL Interface screen – see "Edit - General Ledger Config - Distribution Interface".

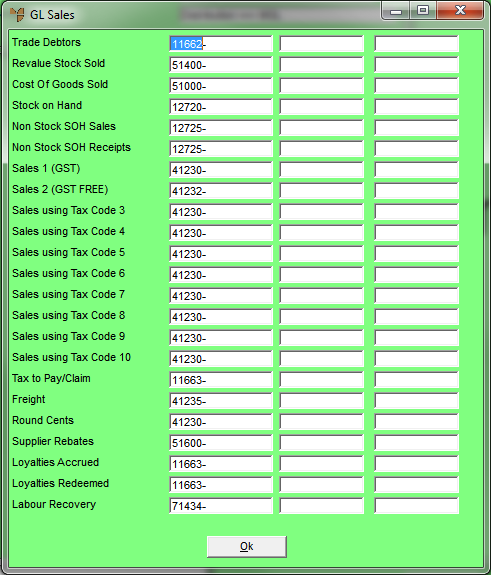

You use the GL Sales screen to setup your GL interface (integration table) for MDS sales transactions so that financial data is transferred automatically to the correct accounts in MGL. This table contains the GL accounts for financial transactions relating to sales invoicing to customers.

|

|

|

Reference This GL interface relates to the Dissect the Sales Desk fields in the Config GL Interface screen – see "Edit - General Ledger Config - Distribution Interface". |

To setup your GL interface for sales transactions:

Refer to "Adding a New GL Interface Record" or "Updating a GL Interface Record".

Micronet displays the GL Sales screen.

|

|

Field |

Value |

|---|---|---|

|

|

Trade Debtors |

Enter the GL account that reports the value of unpaid customer invoices in the Balance Sheet of the General Ledger. These amounts add value to a business and naturally appear in the Assets section of the Balance Sheet. MDS increases this GL account (debit) when a sale is raised to a customer. Alternatively, it reduces this GL account when a customer makes a payment (credit). |

|

|

|

Technical Tip The Trade Debtors GL account must be set to Accounts Receivable in the Account Position field of the Account File Update screen (refer to "File - GL Accounts - GL Account"). |

|

|

|

Technical Tip The two fields next to each field on this screen are for entry of T1 and T2 accounts. If your company uses T accounts to flag transactions for GL reporting, enter the default T1 account for the GL account in the first field and the default T2 account for the GL account in the second field. You can also press spacebar then Enter to select these T accounts. For more information about T accounts, see "T Accounts". |

|

|

Revalue Stock Sold |

The most common method of valuing Stock on Hand in MDS is by average cost. Average cost provides greater procedural flexibility in a high level stock system. Micronet treats average cost as a standard cost rather than as a true average that updates and revalues each time stock is received and costed. Amounts relating to Revalue Stock Sold are generated when average cost is being used for stock valuation in Micronet. It is essentially an adjustment that occurs to correct Cost of Sales from standard to actual where items have been sold prior to receiving, thus forcing the stock levels in Micronet into negative. The goods may be physically in stock but Micronet has not been updated to include them in the stock available for sale. As each sales invoice is entered and printed in MDS, the sales and Cost of Sales values are transferred together to the General Ledger. Where this occurs, Micronet values the goods sold at the average or standard cost defined in the system at the time of sale. Micronet transfers this cost to your Profit & Loss. Revalue Stock Sold occurs when you eventually update your inventory files and receive the goods into MDS. If there was a variance between the average or standard and the actual cost, Micronet calculates the difference and transfers this amount to the Profit & Loss. This effectively ensures that the actual cost is now reflected in your Cost of Sales. Revalue Stock Sold is a purchase price variance. This account posts either a debit (additional expense) or a credit (reduction to expense) to Revalue Stock Sold in the Cost of Sales section of the Profit & Loss. It is generally recommended that individual GL accounts for purchase price variances appear separately in the GL Chart of Accounts under the Cost of Sales section of the chart rather than collected together within the one GL account. This ensures that any abnormalities in the cost prices of your products or services can be identified quickly and effectively. It also means that you can identify where, when and how problems or errors occurred during data entry in MDS. |

|

|

Cost of Goods Sold |

Enter the GL account that represents your Cost of Sales - that is, the amount you have paid for the items you have sold. Micronet generally values Stock on Hand at average or standard cost, therefore, when Cost of Sales is transferred to the Profit & Loss from the Stock account, the cost is a reflection of the average or standard. The Cost of Sales GL account should be a separate and individual GL account in the Profit & Loss of the General Ledger. This account can be verified and balanced against various MDS End of Month reports. This account posts a debit (increasing expense) to the Cost of Sales section of the Profit & Loss. |

|

|

|

Technical Tip The cost of non-inventory items sold also transfers through this GL account. Micronet integration and MGL treat these items in the same manner as diminishing inventory items. This is for accounting purposes only. MDS treats them as non-stock items and does not show them as being on hand. |

|

|

Stock on Hand |

Enter the GL account that represents the cost value of the stock currently being held for sale or manufacture. It is an asset account and is generally valued by MDS at average or standard cost. However, other stock valuation options exist such as FIFO (First in First Out) or LIFO (Last in Last Out). These two stock valuation options are especially effective for stock affected by serial numbers. This account posts a debit (increase to stock) or a credit (decrease to stock) in the Current Assets section of the Balance Sheet. |

|

|

|

Technical Tip The Stock on Hand GL account must be set to Stock in the Account Position field of the Account File Update screen (refer to "File - GL Accounts - GL Account"). |

|

|

Non Stock SOH Sales |

Enter the GL account that represents the sale of non-inventory items. This GL account represents the cost of non-inventory items and the account from which the cost should be transferred. This is generally a Stock on Hand GL account. While MDS treats these items as non-inventory items, MGL still regards them as Stock on Hand for accounting purposes. Therefore accounting entries occur in the Stock on Hand GL account when a non-inventory item is received and when it is sold. When non-inventory items are sold, Micronet decreases the specified Stock GL account in the General Ledger only and transfers the cost of the items to Cost of Sales in the Profit & Loss. The GL account entered at Non Stock SOH Sales should represent the GL account being decreased - that is, the relevant GL Stock account. This account posts a credit (reducing assets) against the Stock on Hand account in the Current Assets section of the Profit & Loss, thereby reducing the value of the stock being held. |

|

|

Non Stock SOH Receipts |

Enter the GL account that represents the cost of non-inventory items being received into MDS. While MDS treats these items as non-inventory items, MGL still regards them as Stock on Hand for accounting purposes. This account therefore represents the GL Stock account that is used to record the value of non-inventory items received and held for sale. This account posts a debit to the Stock on Hand account in the Current Assets section of the Balance Sheet, thereby increasing the financial value of the Stock. |

|

|

Sales 1 (GST) |

Enter the main GL account for sales transactions. This account is used to record the exclusive sales value of customer invoicing and adjustment (credit) notes. |

|

|

Sales 2 (Free) |

Enter the GL account that represents sales which are exclusive of GST and are transferred to the Revenue section of the Profit & Loss. This account is used to post credits (increasing income) from customer invoicing for the sales value of stock items being sold. |

|

|

Sales Using Tax Code 3, 4, 5, 6, 7, 8, 9, 10 |

Enter the GL accounts that represent sales that are treated differently for GST purposes - for example, sales inclusive of WET (Wine Equalisation Tax). These accounts are used to post credits (increasing income) to the relevant sales accounts from customer invoicing for the sales value of stock items being sold. They appear in the Revenue section of the Profit & Loss. The tax code labels displayed in these fields are user defined. For more information, refer to "Edit Company - Edit - Tax Tables". |

|

|

Tax to Pay/Claim |

Enter the GL accounts that represent the GST amounts appearing on customer invoices. The GL account entered in this field is for the GST Payable Account in the Current Liabilities section of the Balance Sheet. This account accumulates any GST on customer invoices, posting credits (increasing liabilities) from customer invoicing for the GST value of stock items being sold. |

|

|

Freight |

Enter the GL account that reflects the value of freight charged to customers for the delivery of goods sold on customer invoices. This account is used to post credits (increasing income) from customer invoicing for the freight charged and entered at the time of preparing a customer's invoice. This account appears under Freight Income in the Revenue section of the Profit & Loss. |

|

|

Round Cents |

Rounding relates more specifically to the Point of Sale ledger or Cash Sales options in MDS where rounding for cash sales occurs. This GL account should represent Sales as a debit (reduction to sales) or a credit (increase to sales) depending on the rounding that has occurred on payment of a customer invoice. |

|

|

Supplier Rebates |

Where supplier rebates have been entered and offset against the cost of individual items within MDS, an adjustment needs to be made to the Cost of Sales accounts in MGL. As the value of the Stock on Hand has been reduced, Micronet needs to transfer this cost to the Profit & Loss. This in turn reduces the amount transferred at sale for Cost of Sales. These amounts are eventually offset by the receipt of the actual rebate income received and banked. MDS posts a credit (reducing assets) to the Stock on Hand account in the Current Assets section of the Balance Sheet, and posts a debit (increasing expense) in the Cost of Sales section of the Profit & Loss. This reduces the value of the stock by the rebate, revaluing the cost on each item correctly and transferring the adjustment amount to a Cost of Sales Adjustment Account in the Profit & Loss. For example:

The reason for staggered transfer to the Profit & Loss is mainly for reporting purposes in MDS. Gross margins on individual products can be reported taking into account the rebates received from suppliers, thus reflecting a true margin on a product-by-product basis. When the actual rebate is banked and recorded in MGL as income, the value of the Cost of Sales matches the value recorded in MDS. Both ledgers reflect the effect that rebates received from suppliers have on your products and financial records. |

|

|

Loyalties Accrued |

Enter the GL account that represents Loyalties Accrued. This GL account accumulates the value of debtor rebates pending in MDS. When rebate payment types are selected, this reduces the Loyalties Accrued GL account. These transactions will therefore not update to the bank. |

|

|

Provision for Loyalties |

This has been changed to Loyalties Redeemed in 2.8. |

|

|

Labour Recovery |

If your company uses the Field Service module to manage a fleet of mobile technicians or installers, enter the Labour Recovery account for field service jobs. For more information about Field Service, refer to "Wide Warehouse Scheduler - Field Service". |

Micronet redisplays the Change GL Interface screen.